Two Positive Changes That Will Allow You to Buy More House and Pay Less!

The positive change is that the Federal Housing Finance Agency (FHFA), Federal Housing Administration (FHA), and the Department of Veterans Affairs (VA) have increased loan limits for 2017. The second change is that the Federal Housing Administration (FHA) has decided to lower the Annual required mortgage insurance (MI) on loans. Basically one agency (FHFA) is allowing you to buy bigger homes and the other agency (FHA) is allowing you to pay less for that home. These new loan limits, as well as their impact to pricing and underwriting, are summarized below.

Conventional Conforming Loan Limits – are for Conforming – VA and FHA

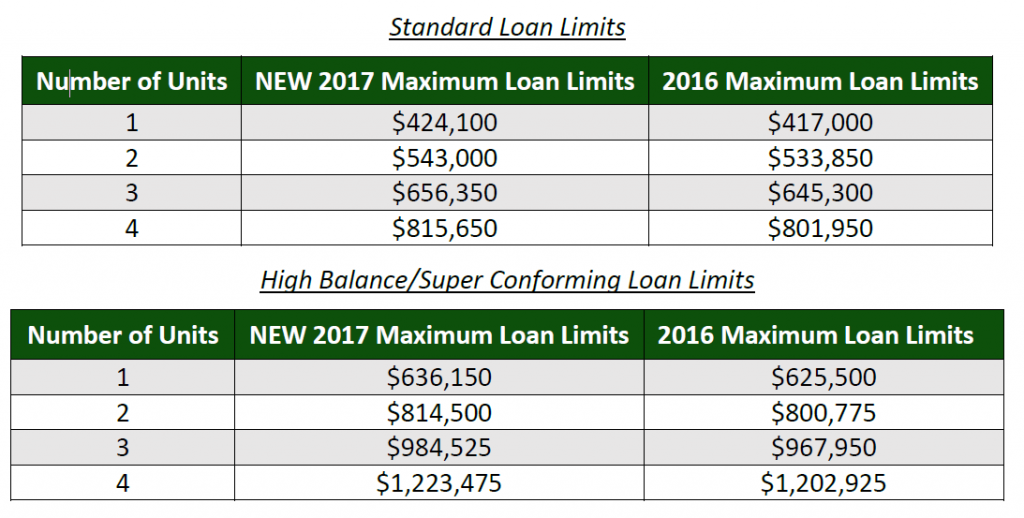

The following tables outline the difference in maximum loan limits from 2016 to 2017, based on number of units, for Standard and High Balance/Super Conforming loans. In most of the country, the 2017 standard maximum loan limit for one-unit properties will be $424,100. In high-cost areas, higher loan limits will also be in effect.

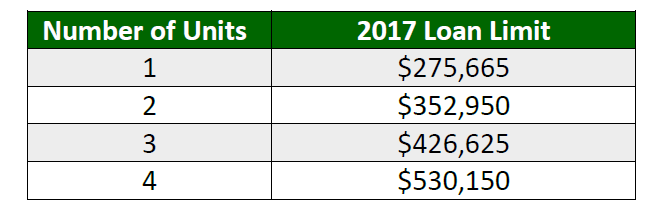

Low Cost Area

(Set at 65% of the national conforming limit of $424,100 for a one-unit property.)

For specific county loan limits, refer to the FHFA website for additional details. linkhttps://www.fhfa.gov/DataTools/Downloads/Pages/Conforming-Loan-Limits.aspx

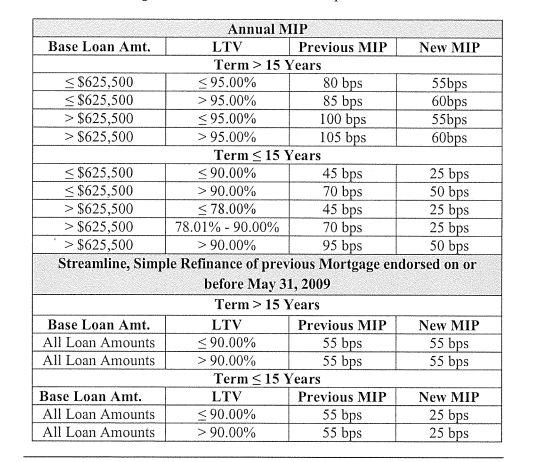

FHA – Mortgage Insurance Change

FHA has reduced the annual mortgage insurance rate by .25 basis points effective with closings on or after January 27, 2017. The annual mortgage insurance is collected on all FHA loans and is the insurance monies used to meet claims in case of defaults. You can see the proposed changes in the chart below.

EX: $424,100 (@3.25= $1845.71 PI) New loan amount

Previous MI rate (.85) = $300.40 per month

New MI rate (.60)= $212.05 per month

Previous $417,000@3.25=$1814.81 PI + $300.40= $2115.21

New LA $424,100@3.25=$1845.71 PI + $212.05= $2057.76

These exciting new developments show that the housing market is continuing to come back. The change in the FHA premium basically saves a client $88.40 on a max conforming loan at $424,100. The savings on the MI depending on the interest rate; pays for the loan increase or allows higher purchasing power for same cost as before. The combination of both of these changes allows for more purchasing power with the same payment or a lower payment buying the same house. A true win win for the industry.

Notice; Information about the author: Kevin Retcher is the Owner of First Meridian Mortgage since 1996 and can be reached at 703-799-5636, kevin@firstmeridianmortgage.com. His opinions are his and his alone, and not to be taken as legal advice. Always consult with a licensed professional. Also excuse grammar and spelling, I work with math for a living. © First Meridian Mortgage Corporation. NMLS# 180004 www.nmlsconsumeraccess.org, ©KSA Insurance agency, License NPN 8036794 VA License, Rates are subject to change without notice.